Gst For Kitchen Items . computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. Representations have been received seeking. Table, kitchen or other household articles and parts thereof, and pot scourers and scouring or polishing. Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. 21 rows gst% 761510: Electrical machinery and equipment and parts. gst rates and hsn code for other domestic appliances. Gst rates and hsn code for tableware and kitchenware. domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,.

from blog.saginfotech.com

19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. 21 rows gst% 761510: Representations have been received seeking. computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. gst rates and hsn code for other domestic appliances. domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. Electrical machinery and equipment and parts. Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics Table, kitchen or other household articles and parts thereof, and pot scourers and scouring or polishing. Gst rates and hsn code for tableware and kitchenware.

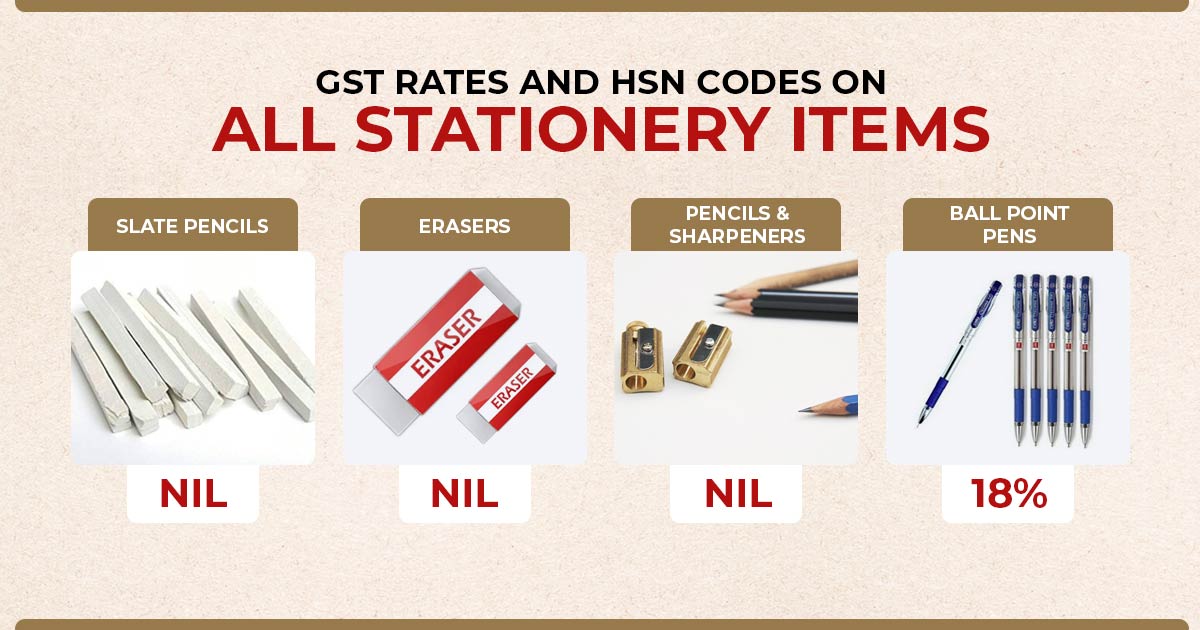

New List of GST Rates & HSN Codes on All Stationery Items

Gst For Kitchen Items domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. Table, kitchen or other household articles and parts thereof, and pot scourers and scouring or polishing. 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. Representations have been received seeking. domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. 21 rows gst% 761510: computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. gst rates and hsn code for other domestic appliances. Electrical machinery and equipment and parts. Gst rates and hsn code for tableware and kitchenware. Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics

From margcompusoft.com

Calculate GST Online with GST Calculator Marg ERP Blog Gst For Kitchen Items computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. Electrical machinery and equipment and parts. Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics Gst rates and hsn code for tableware and kitchenware. 21 rows gst% 761510: 19 rows get all 6 digit and. Gst For Kitchen Items.

From blog.saginfotech.com

New List of GST Rates & HSN Codes on All Stationery Items Gst For Kitchen Items Representations have been received seeking. Electrical machinery and equipment and parts. domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. Gst rates and hsn code. Gst For Kitchen Items.

From www.youtube.com

Impact of GST on Kitchen which Kitchen item got cheaper or Costlier after GST?? Full Kitchen Gst For Kitchen Items 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. Gst rates and hsn code for tableware and kitchenware. 21 rows gst% 761510:. Gst For Kitchen Items.

From www.pinterest.com

List of 70+ Kitchen Utensils Names with Pictures Kitchen utensils, Kitchen tool names, Kitchen Gst For Kitchen Items domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. 21 rows gst% 761510: Representations have been received seeking. Tableware, kitchenware, other household articles and. Gst For Kitchen Items.

From ebizfiling.com

A complete guide on GST rate on food items Gst For Kitchen Items 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics 21 rows gst% 761510: gst rates and hsn code for other domestic appliances. domestic appliances encompass a wide range. Gst For Kitchen Items.

From www.taxscan.in

GST ITC allowable in respect of Fresh and Semi Processed Meat Products AAR Gst For Kitchen Items Electrical machinery and equipment and parts. Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics Gst rates and hsn code for tableware and kitchenware. 21 rows gst% 761510: Table, kitchen or other household articles and parts thereof, and pot scourers and scouring or polishing. 19 rows get all 6 digit and 8 digit codes and. Gst For Kitchen Items.

From www.thestatesman.com

GST Council lowers tax rates for 66 items The Statesman Gst For Kitchen Items Representations have been received seeking. Gst rates and hsn code for tableware and kitchenware. 21 rows gst% 761510: 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. Electrical machinery and equipment and parts. gst rates and hsn code for other domestic. Gst For Kitchen Items.

From blog.saginfotech.com

FM Nirmala Sitharaman Releases GST Exempted 14 Food Items List Gst For Kitchen Items domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. Representations have been received seeking. gst rates and hsn code for other domestic appliances. 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. Table,. Gst For Kitchen Items.

From loveenglish.org

Kitchenware 35 Names Of Essential Kitchen Items In The Kitchen Love English Gst For Kitchen Items 21 rows gst% 761510: Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. Electrical machinery and equipment and parts. Table, kitchen or other household articles and parts thereof, and pot scourers and scouring or polishing. . Gst For Kitchen Items.

From medium.com

GST Query Taxogst Medium Gst For Kitchen Items 21 rows gst% 761510: domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. Table, kitchen or other household articles and parts thereof, and pot scourers and scouring or polishing. Representations. Gst For Kitchen Items.

From www.storyboardthat.com

States of Matter Featuring Kitchen Items Storyboard Gst For Kitchen Items Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics Electrical machinery and equipment and parts. computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. gst rates and hsn code for other domestic appliances. Gst rates and hsn code for tableware and kitchenware. Table, kitchen or. Gst For Kitchen Items.

From www.scribd.com

Materials for HSN Codes (Sales) Gas Technologies Home Appliance Gst For Kitchen Items Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics Gst rates and hsn code for tableware and kitchenware. 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. computer hardware is classified under the hsn code of the specific type. Gst For Kitchen Items.

From www.taxheal.com

TaxHeal GST and Tax Complete Guide Portal Gst For Kitchen Items 21 rows gst% 761510: computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. Gst rates and hsn code for tableware and kitchenware. domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. Table, kitchen or other household articles and parts. Gst For Kitchen Items.

From www.afarmgirlsdabbles.com

2022 Kitchen Gift Guide My Top 55 Favorite Kitchen Gifts A Farmgirl's Dabbles Gst For Kitchen Items Electrical machinery and equipment and parts. domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. Gst rates and hsn code for tableware and kitchenware. computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. Representations have been received seeking. Table, kitchen. Gst For Kitchen Items.

From razorpay.com

GST Rates in 2024 List of Goods & Service Tax Rates Slabs Gst For Kitchen Items Representations have been received seeking. 21 rows gst% 761510: Electrical machinery and equipment and parts. 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,.. Gst For Kitchen Items.

From dxoxbzzhg.blob.core.windows.net

Furniture And Fixtures Gst Rate at Kurt Hutchings blog Gst For Kitchen Items Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. 19 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 7323 table, kitchen or other household articles, and. gst. Gst For Kitchen Items.

From www.scribd.com

List of Exempted Goods Under GST With HSN Code PDF Citrus Vegetables Gst For Kitchen Items computer hardware is classified under the hsn code of the specific type of hardware, and the gst rate varies. Table, kitchen or other household articles and parts thereof, and pot scourers and scouring or polishing. gst rates and hsn code for other domestic appliances. 19 rows get all 6 digit and 8 digit codes and their gst. Gst For Kitchen Items.

From www.indiafilings.com

GST on mechanical appliances Articles IndiaFilings Gst For Kitchen Items domestic appliances encompass a wide range of products used in households for various purposes, such as cooking,. gst rates and hsn code for other domestic appliances. Gst rates and hsn code for tableware and kitchenware. Representations have been received seeking. Table, kitchen or other household articles and parts thereof, and pot scourers and scouring or polishing. 21. Gst For Kitchen Items.